Mold and Insurance Claims in Cocoa: What Homeowners in Brevard County Should Know

Mold and insurance claims often cause confusion for homeowners in Cocoa. Many people assume that if mold appears, insurance automatically covers the damage. In reality, coverage usually depends on what caused the mold, not just the mold itself.

I’ve seen homeowners surprised when claims were approved in one situation but denied in another that looked similar. Ever wonder why two homes with mold damage can have completely different claim outcomes? The cause of the moisture almost always explains the difference.

Let’s break down how mold and insurance claims work and what homeowners in Brevard County should know.

How Insurance Companies Evaluate Mold Claims

Insurance providers usually focus on the source of water or moisture that caused the mold.

Situations that may be covered:

- Sudden plumbing leaks

- Appliance failures

- Storm-related water intrusion

Situations often not covered:

- Long-term leaks

- High humidity

- Poor maintenance

Policies vary, but most insurers distinguish between sudden damage and gradual problems.

Rhetorical question time: if a leak continues for months without repair, would an insurer consider it sudden damage? Usually not.

Why Documentation Is So Important

When mold develops after a water event, documentation helps support an insurance claim.

Helpful documentation may include:

- Photos of damage and moisture

- Dates of when the problem occurred

- Inspection reports

- Repair invoices

Clear records help demonstrate the timeline of the damage and the steps taken to address it.

FYI, taking photos early often helps avoid disputes later.

The Role of Mold Inspection in Claims

Mold inspection provides valuable information that may help during the claims process.

Inspection can identify:

- The source of moisture

- Areas affected by mold

- The extent of contamination

Inspection reports often help clarify whether mold developed from a specific water event or from long-term moisture.

Testing may also help determine airborne mold levels when indoor air quality becomes a concern.

Inspection provides evidence rather than assumptions.

Why Quick Action Matters After Water Damage

Acting quickly after water damage helps limit both mold growth and complications with insurance claims.

Recommended steps include:

- Stopping the source of water

- Drying affected areas promptly

- Documenting the damage

- Scheduling inspection if mold is suspected

Delays allow moisture to remain in building materials, increasing the chance of mold and making claims more complicated.

Ever notice how damp materials develop odors within a few days? That’s how quickly mold can begin forming.

Common Causes of Mold Claims in Cocoa Homes

In Brevard County, mold-related claims often follow:

- Roof leaks after storms

- Plumbing failures

- Appliance leaks

- Water heater issues

These events introduce sudden moisture, which often plays a key role in claim approval, depending on policy details.

Small events can still qualify if they occur suddenly and are reported promptly.

Why Mold Sometimes Appears Weeks Later

Mold often develops gradually after water damage because moisture becomes trapped inside materials.

Materials that hold moisture include:

- Drywall

- Insulation

- Wood framing

Even when surfaces feel dry, internal moisture may remain long enough for mold to grow.

Ever wonder why walls can look dry but still smell musty? Moisture inside materials often explains that.

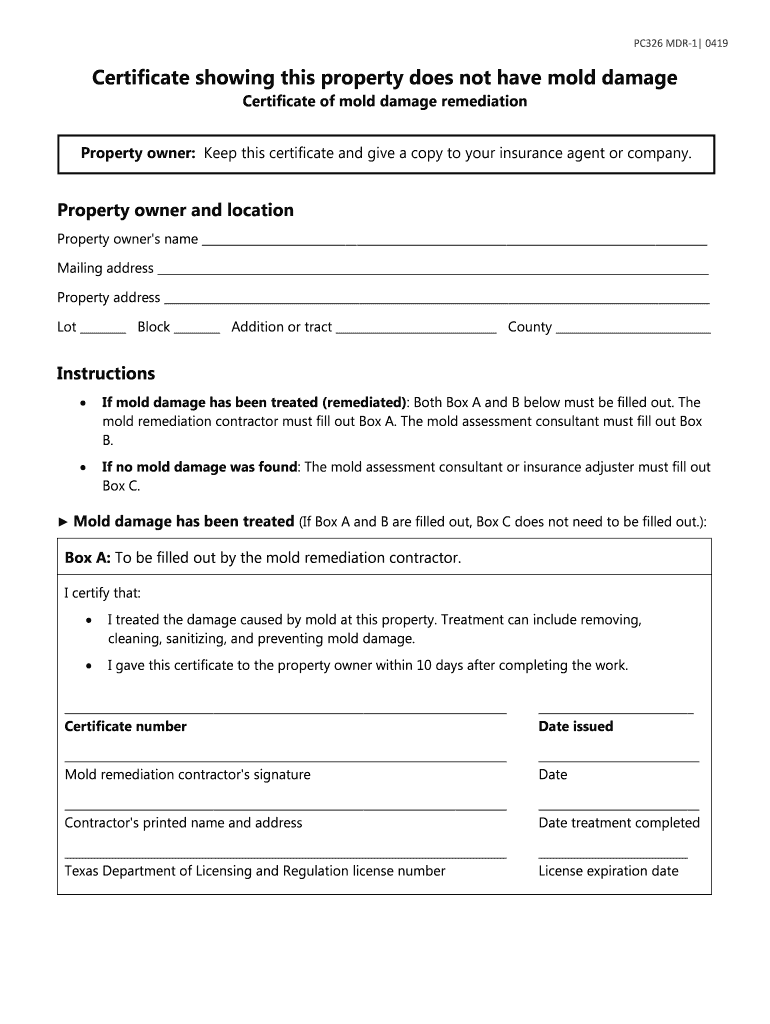

Mold Removal and Remediation After a Claim

If mold is confirmed, remediation may include:

- Removing contaminated materials

- Cleaning structural surfaces

- Drying affected areas thoroughly

- Correcting moisture sources

Containment and air filtration may also be used to prevent spores from spreading during cleanup.

The goal is to restore dry, stable conditions and prevent mold from returning.

Preventing Mold Problems That Lead to Claims

Preventive maintenance reduces the chance of mold-related insurance claims.

Homeowners can help by:

- Inspecting roofs and plumbing regularly

- Maintaining HVAC systems

- Repairing leaks promptly

- Monitoring humidity levels

These steps help prevent moisture problems before they become serious.

Ever notice how homes that stay dry rarely develop persistent odors? Moisture control makes the biggest difference.

Why Understanding Your Policy Matters

Homeowners often learn about coverage limits only after damage occurs. Reviewing policy details in advance helps clarify:

- Coverage limits

- Deductibles

- Exclusions

- Required documentation

Knowing these details helps homeowners respond faster and avoid surprises during the claims process.

Preparation helps reduce stress when unexpected damage occurs.

Why Acting Early Saves Time and Money

One consistent lesson from inspections is that early drying and inspection reduce both repair costs and claim complications.

When homeowners act early:

- Mold remains limited

- Repairs stay smaller

- Claims move more smoothly

Waiting allows mold to spread into hidden areas, increasing both cost and repair time.

Maintenance almost always costs less than restoration.

Final Thoughts

Mold and insurance claims in Cocoa homes depend largely on the cause of moisture and how quickly homeowners respond. Sudden water events, prompt drying, and proper documentation often play a major role in claim outcomes.

Understanding how mold develops and how insurance companies evaluate damage helps homeowners navigate the process with greater confidence and fewer surprises.