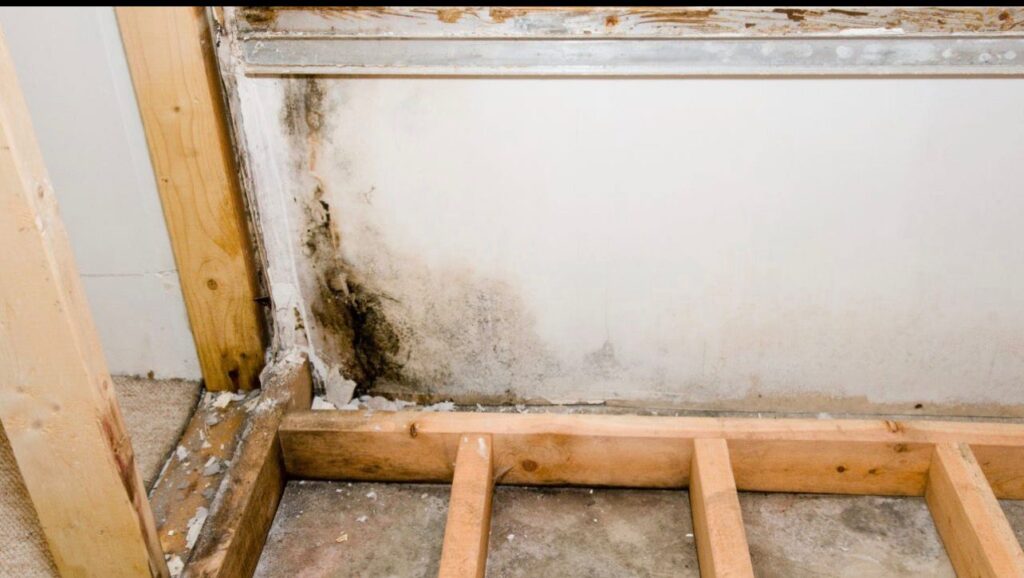

Mold and Insurance Claims in Cocoa: What Homeowners in Brevard County Should KnowMold and insurance claims are closely connected issues for homeowners in Cocoa and throughout Brevard County. Florida’s humidity, frequent storms, and aging homes make water damage and mold common, but insurance coverage for mold is often misunderstood. Many homeowners assume mold is automatically covered, only to face claim denials or limited payouts. Understanding how insurance policies treat mold, what documentation is required, and how to protect your claim can make a significant difference when mold damage occurs.⸻Why Mold Claims Are Common in CocoaCocoa’s coastal and river-adjacent location exposes homes to persistent moisture. Heavy rain, tropical storms, plumbing leaks, roof failures, and HVAC condensation all contribute to water damage that can lead to mold.Mold often develops quickly after water intrusion, sometimes within 24 to 48 hours. If moisture is not dried thoroughly, mold growth can spread behind walls, under flooring, and into insulation long before it becomes visible. Insurance claims often arise when homeowners discover mold weeks or months after the initial water event.⸻How Home Insurance Policies Treat MoldMost homeowners insurance policies do not cover mold as a standalone issue. Instead, coverage depends on the cause of the mold.Mold may be covered when it results from a sudden and accidental covered peril, such as:Burst plumbing pipesSudden appliance failuresAccidental water overflowStorm-related roof damageMold is typically excluded when it results from:Long-term leaksOngoing humidity issuesPoor maintenanceSlow plumbing dripsRepeated condensation problemsInsurance companies focus on whether the water damage was sudden and unavoidable or gradual and preventable.⸻Why Mold Claims Are Often DeniedMany mold claims in Cocoa are denied because insurers determine that the mold resulted from delayed action or maintenance issues. Even when the original water damage was covered, mold may be excluded if the homeowner did not take prompt steps to dry and prevent further damage.Common reasons for denial include:Failure to report water damage quicklyLack of documentation showing the source of moistureEvidence of long-term leaksPre-existing mold conditionsInsufficient drying after a water eventInsurance policies often require homeowners to take reasonable steps to mitigate further damage.⸻The Importance of Timing After Water DamageTiming is critical when dealing with mold and insurance claims. Mold growth can begin quickly, but insurance carriers expect homeowners to act immediately after discovering water damage.Important steps include:Stopping the source of waterDrying affected areas promptlyDocumenting damage with photos and notesReporting the claim as soon as possibleDelays can give insurers grounds to argue that mold growth was preventable.⸻Documentation That Strengthens Mold ClaimsStrong documentation is one of the most important factors in mold-related insurance claims.Helpful documentation includes:Photos and videos of water damageDates and times of discoveryRecords of emergency repairsProfessional inspection reportsMoisture readings and drying logsInvoices for mitigation and repairsProfessional inspections help establish timelines and identify whether mold resulted from a covered water event.⸻Mold Testing and Insurance ClaimsMold testing is sometimes used to support insurance claims, but it does not guarantee coverage. Testing can help confirm the presence of mold and document indoor air quality conditions, especially when mold is hidden.Insurance companies generally care more about the cause of moisture than the type of mold present. Testing is most useful when paired with evidence showing a sudden water loss.⸻Mold Remediation and Insurance CoverageInsurance policies may cover mold remediation costs when mold is directly linked to a covered water event. Coverage limits for mold are often capped, even when approved.Homeowners should be aware that:Some policies have specific mold sub-limitsRemediation must follow approved proceduresUnauthorized repairs may complicate claimsIt is often best to confirm coverage details before proceeding with major remediation when possible.⸻The Role of Professional InspectionsProfessional inspections play a key role in mold and insurance claims. Inspectors focus on identifying moisture sources, assessing the extent of damage, and documenting conditions accurately.Inspection reports help clarify:Whether mold is active or dormantHow moisture entered the homeWhether damage appears sudden or long-termAreas affected by water and moldClear, unbiased documentation strengthens communication with insurers.⸻Common Mistakes Homeowners MakeHomeowners sometimes unintentionally harm their insurance claims.Common mistakes include:Waiting too long to report water damageCleaning or removing damaged materials before documentingUsing bleach or paint to hide moldFailing to address moisture sourcesAssuming mold is automatically coveredThese actions can make it difficult to prove the cause and timeline of mold growth.⸻Preventing Mold Claim Issues in the FuturePrevention reduces both mold risk and insurance disputes.Effective prevention steps include:Maintaining roofs and plumbingServicing HVAC systems regularlyControlling indoor humidityInspecting after stormsAddressing leaks immediatelyKeeping records of maintenance and repairsHomes with good maintenance documentation often face fewer claim challenges.⸻Mold, Claims, and Property ValueUnresolved mold issues can reduce property value and complicate future insurance coverage. Buyers and insurers may view properties with mold histories as higher risk.Proper remediation, moisture correction, and clear documentation help protect long-term value and insurability.⸻When Professional Guidance Is HelpfulProfessional guidance is often beneficial when:Mold appears after water damageInsurance coverage is unclearClaims are delayed or disputedDamage appears extensive or hiddenEarly professional involvement often prevents costly mistakes and prolonged disputes.⸻Final ThoughtsMold and insurance claims in Cocoa can be complex, especially in Brevard County’s humid climate. Coverage depends largely on the cause of moisture and the homeowner’s response time. Acting quickly after water damage, documenting everything thoroughly, and understanding policy limitations are the most effective ways to protect a mold-related insurance claim.Homeowners who stay proactive with maintenance, respond immediately to water damage, and seek professional documentation when needed are far more likely to achieve favorable outcomes when dealing with mold and insurance claims.